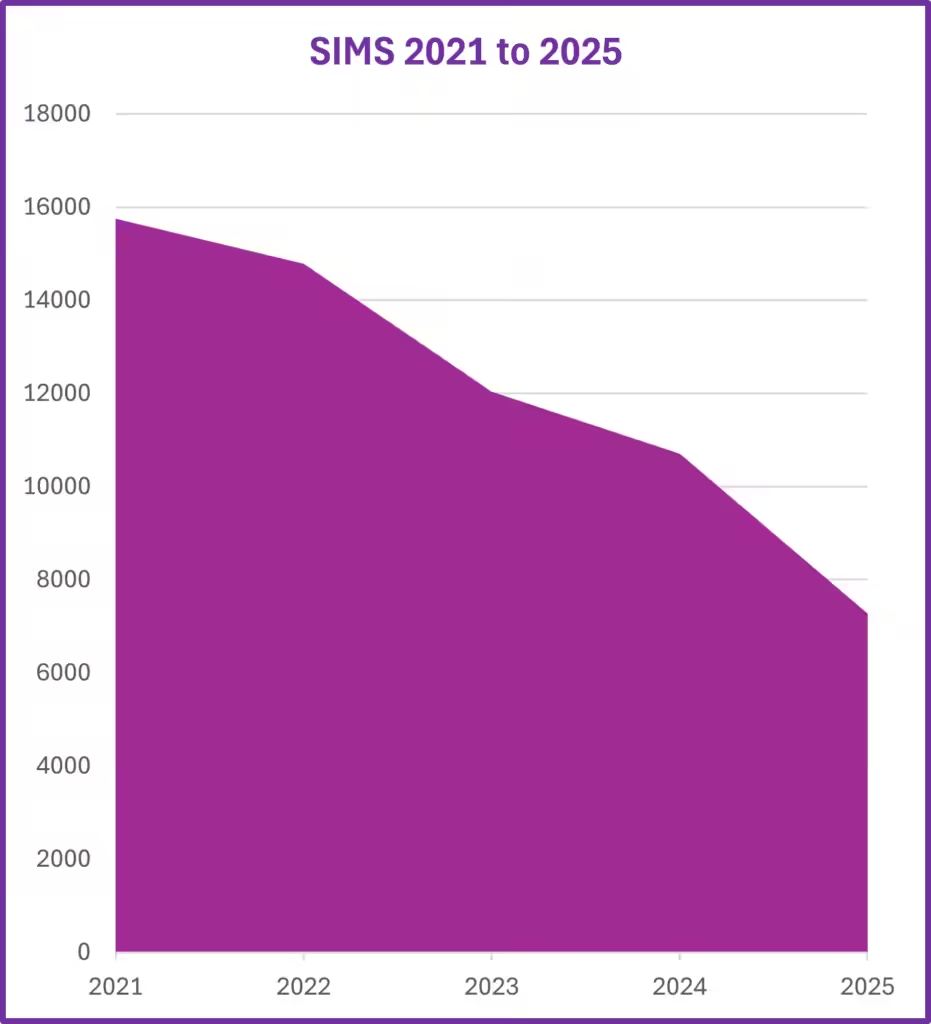

For the past 40 years, since its birth way back in 1984, SIMS has been the market leader in the MIS world every year, with the largest share of the English schools’ market. At its peak, just 10 years ago, SIMS had some 83% of the market.

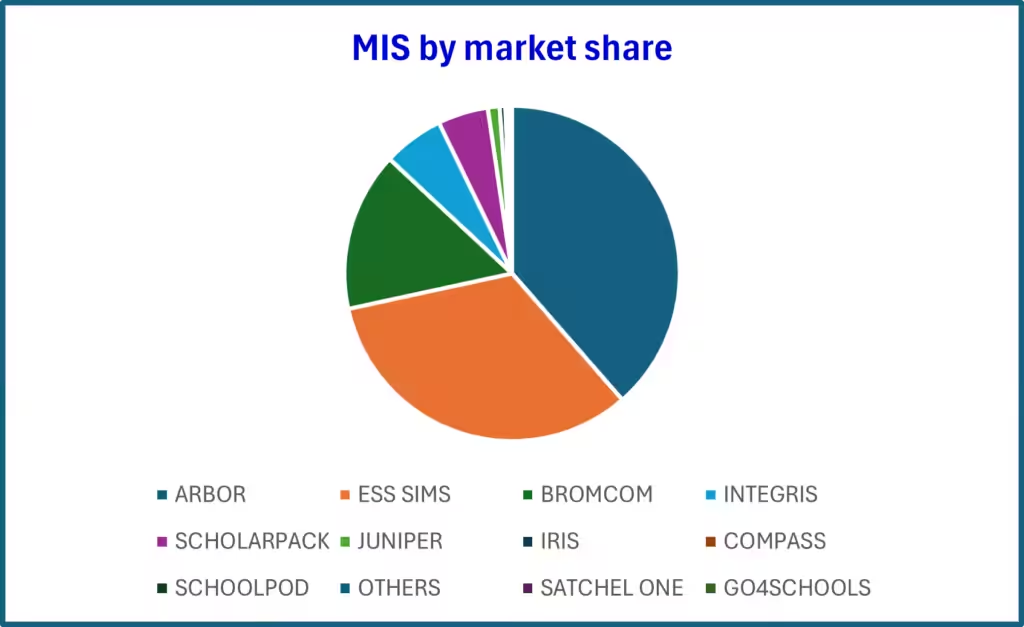

The picture has changed dramatically over recent years, however, and the latest census figures just released (from the summer 2025 census returns) shows that SIMS has finally fallen from its top spot and Arbor have now taken the lead with 38.6% of the English state schools’ market, with SIMS dropping down to just 33%.

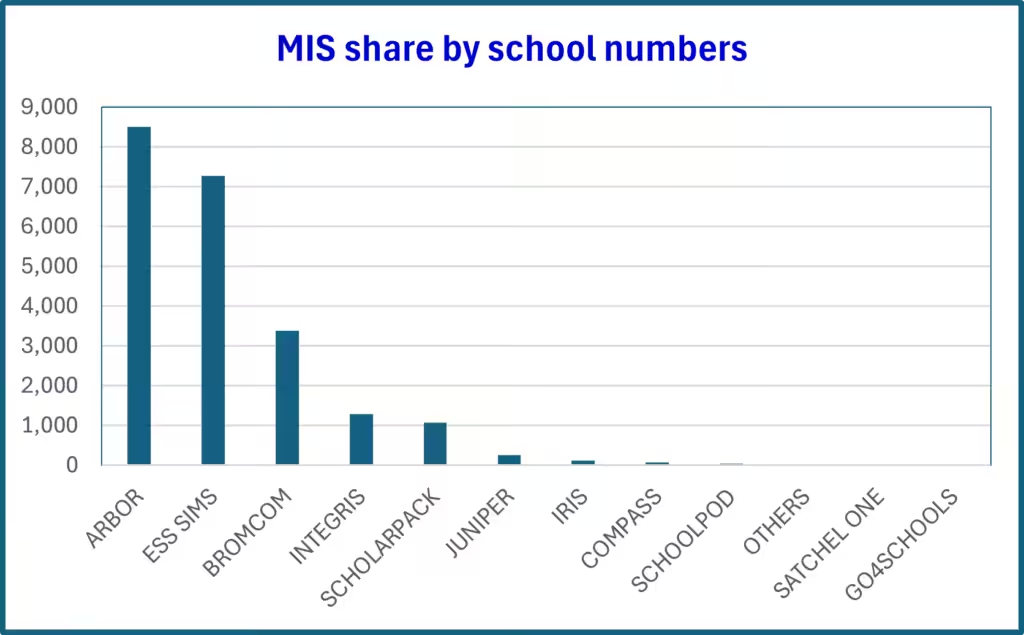

To put this in context, in 2015 SIMS was being used by over 18,000 schools across England, whilst Arbor had just 99. Today, SIMS are reduced to just 7,272 schools compared to Arbor’s 8,500.

Arbor have to be congratulated in their amazing growth over the past 10 years. From just 99 schools up to 8,500 is fantastic growth and they continue to go from strength to strength, gaining schools every term – since the January census alone, they have gained a further 1,121 schools!

At the same time, it must be noted that Arbor, Integris and ScholarPack are all owned by The Key Group and it has previously been announced that both Integris and ScholarPack are being retired by February 2026, with schools being offered the opportunity to move across to the Arbor platform. Indeed, we can see that almost 300 have done so in the last term alone. If the majority of the Integris and ScholarPack schools do decide to join Arbor, rather than explore the MIS market and move to another provider, this would cement Arbor’s position at the top even further, bringing their total number of schools to almost 10,000.

We should be remiss if we don’t also point out the strong growth from their leading contender, Bromcom, who have gained over 600 new schools in the last term, bringing their total up to 3,382 English schools and a very credible 15.5% market share. On top of this, they won the contract for all the 1,116 schools in Northern Ireland and have also won 4 out of the 5 Welsh Local Authorities that have so far moved away from SIMS.

In our post back in March, we reported on the data gleaned from the January 2025 census, which showed SIMS having 8,818 schools. We also pointed out that many schools at that time had already selected a new MIS provider, but carried out the January census using their familiar SIMS software, intending to move across to their new MIS once the census had been completed. We opined then that this meant we would be likely to see further significant change once the summer census was completed – and we have been proven correct.

In that short period between the January census and the May census, SIMS has lost a further 1,546 schools! This means they have lost 18% of their English school customer base in just one term.

Taking this latest data into account, and looking back just 4 years to 2021, when SIMS had almost 16,000 schools, we see that ESS SIMS has lost over 50% of its schools in the last 4 years alone!

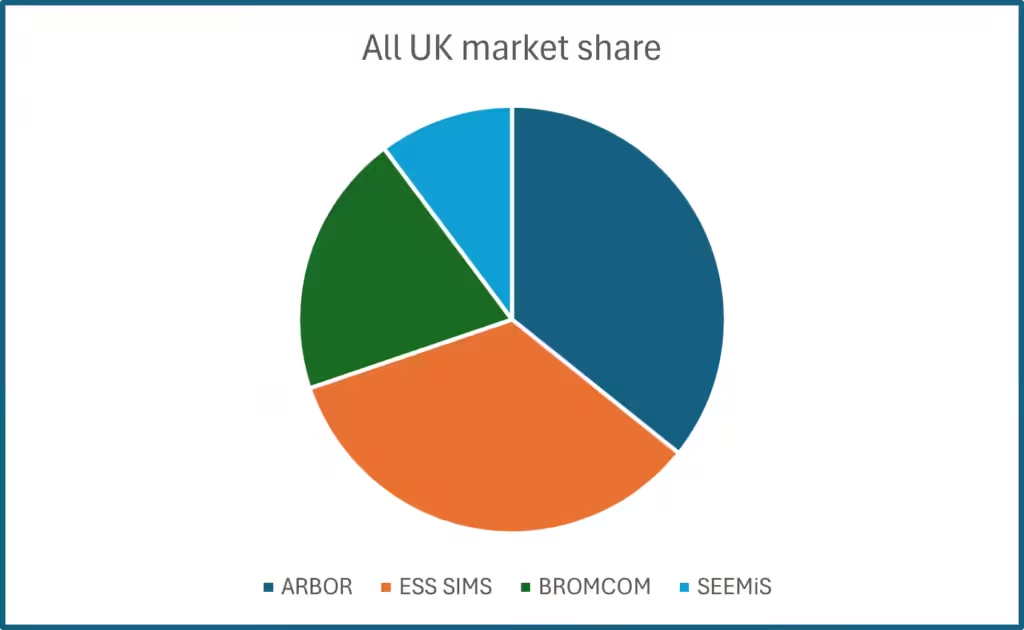

Whilst the above looks at the market in the English school sector only, we also have data on the Wales, Scotland and Northern Ireland sector so that we can look at the UK as a whole.

In Scotland, things remain constant, with the SEEMiS Click’nGo platform being used in all 2,445 maintained schools there. This platform was built and is owned by the 32 Scottish Local Authorities and has been used in all schools there for almost 20 years.

In Northern Ireland, as mentioned above, the contract for all 1,116 schools, previously with ESS SIMS, was awarded to Bromcom.

In Wales, five local authorities have moved away from SIMS to date, with 4 of these (284 schools) choosing Bromcom and one (53 schools) selecting Arbor.

If we take in all the UK data, the picture is as follows:

| MIS | SCHOOL NUMBERS | MARKET SHARE |

| ARBOR | 8,553 | 31.6% |

| ESS SIMS | 8,140 | 30.1% |

| BROMCOM | 4,782 | 17.7% |

| SEEMiS | 2,445 | 9.0% |

Moving back to the English schools market, it is difficult to see where this trend will end.

ESS SIMS still do not have a full cloud-based system to offer schools. Instead, they are rolling out the SIMS Next Gen platform as a series of cloud-based modules over time, with a road map that shows that the final Next Gen cloud-based modules will not be available until the end of 2026.

Given the complex design and build of any software, let alone software that has to interact and work with multiple other platforms as well, whether or not we finally see the completed SIMS Next Gen by the end of 2026 or whether it will be further delayed remains to be seen.

We continue to monitor the MIS sector and look forward to seeing where it goes next. Certainly, there will be significant change over the coming twelve months. We have the next wave of SIMS three-year contracts due to expire in March 2026, as well as the migration of Integris and ScholarPack schools across to the Arbor platform (or whichever other MIS provider they choose) by February 2026.

WhichMIS continue to offer free and impartial advice on MIS procurement as well as MIS procurement project services. If you are thinking about your current MIS platform and whether or not you should consider changing it, please feel free to contact us for free resources and advice to help you make the right decisions.

It may well be that you don’t need to change your MIS at all. Often we see schools and MATs that are not utilising their current MIS to its full potential or are not aware of all the functionality that they already have.

If you do decide to change provider, remember, this is not a small undertaking and should be managed carefully – and that’s where WhichMIS can help.