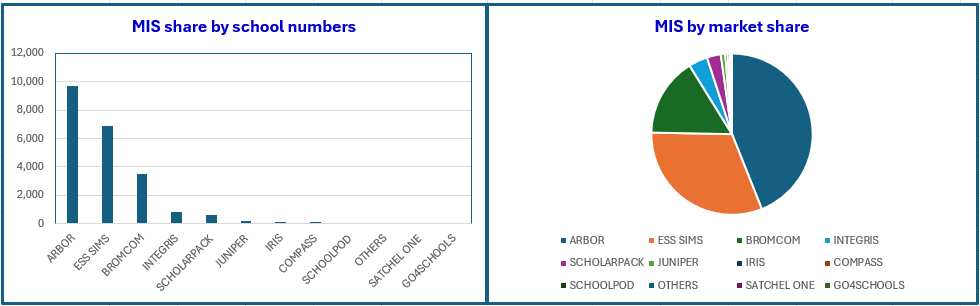

We have just received the data from the latest census of English state schools in October and the trend of MIS churn here continues unabated.

Given that we are approaching Christmas and families start to get out the board games, it seems fitting to see that ‘snakes and ladders’ appear to be out in full force.

Arbor have made massive steps up the ladder in this latest set of data, rising up to 9,677 schools and a market share of 43.97% of English schools.

ESS SIMS, on the other hand, continue to slide down the snake’s back, and are now down to just 6,897 English state schools and a market share slump to just 31.67% – amazing for the MIS that was market leader for many years and had a high of 85% of the market not so long ago!

Bromcom have also risen up a ladder, having now reached 3,493 schools in England and moving their market share here up to 15.87%

When we look at the rise in Arbor English school numbers, from 8,500 in the summer census to 9,677 now, we have to take into account the fact the they are part of The Key Group who also own Integris and ScholarPack MIS. Both these MIS are being phased out and their schools moved to Arbor, so the huge increase in numbers is inflated by this ‘sideways move’ by The Key Group.

Since the summer census, Integris have lost 452 schools and ScholarPack have lost 458. These 910 English state schools have almost certainly been moved by The Key Group to Arbor MIS, inflating their overall numbers significantly.

The total English state schools within The Key Group now stands at 11,127, giving them a majority 50.56%of English schools and making them the market leader here by some distance.

Other MIS companies gaining ground include Compass who move from 72 schools to 102, almost a 50% increase in numbers and a healthy win for them.

We know that this trend is still ongoing – we, ourselves, are helping over 50 schools with their current MIS procurement – and so we fully expect to see further significant churn in the English state sector over the course of the next two census returns.

We say across the next two returns rather than just the January census because, if last years is anything to go by, a large number of the schools moving MIS currently will still complete the January census using their current MIS before finally transitioning to a new one, which means that whilst we will see changes in January, we expect the larger churn to become visible in the summer census 2026.

If we take a look into the UK sector as a whole, we see that Bromcom seem to be ahead here by some margin, having won 5 of the 7 Welsh local authorities that have switched MIS so far.

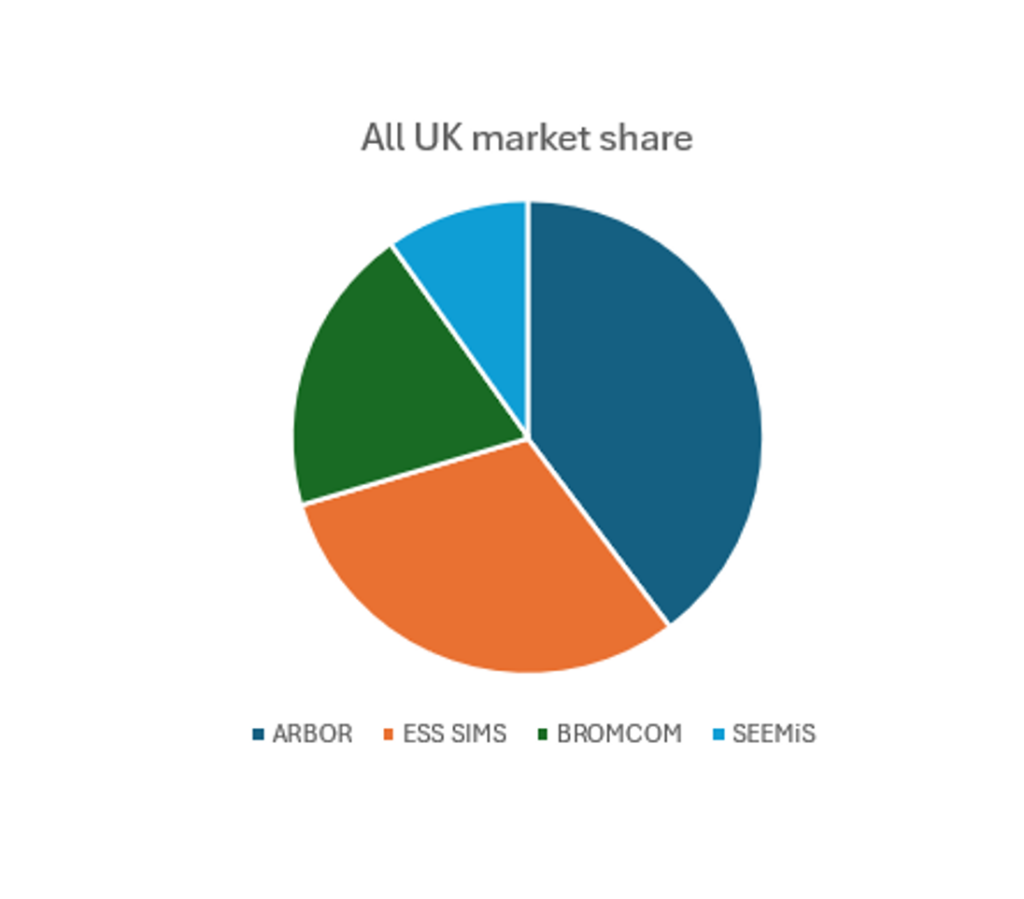

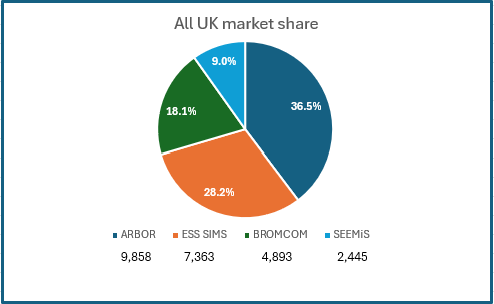

Across the UK as a whole, Arbor have a total of 9,858 schools giving them 36.5% of the UK market; ESS SIMS have 28.2% with 7,6363 total schools; Bromcom with 4,893 schools have 18.1% and SEEMiS with all the 2,445 schools in Scotland take a 9% market share.

As ever, if you are considering a change of MIS, please feel free ro reach out to us for free advice and procurement guidance. We believe it is important that schools and MATs procure the MIS that is best suited to their specific needs and requirements and that they procure in a safe and compliant manner.