The data from the Spring 2024 census has now been published and we can see the latest MIS movements across English state schools.

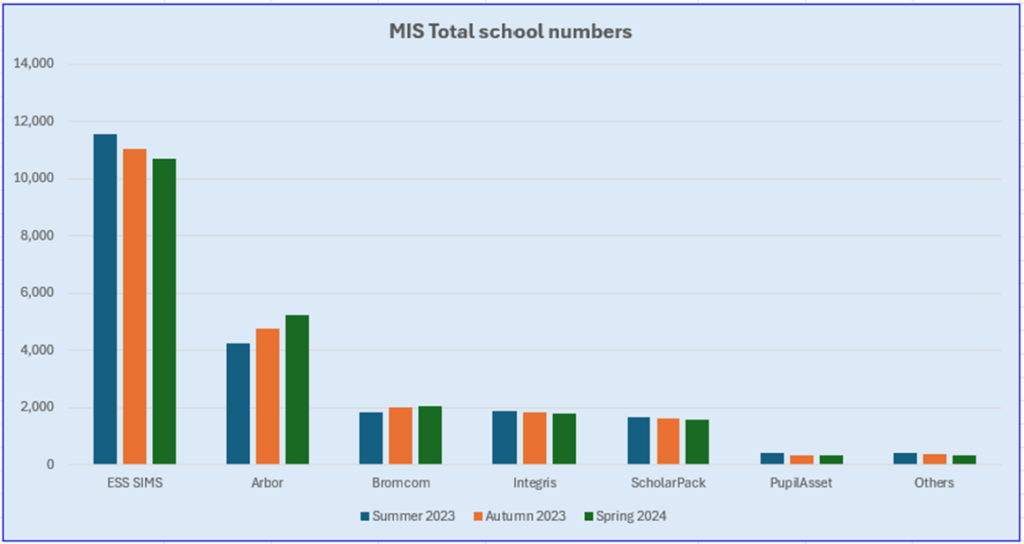

In the period between the Autumn 2023 census and the Spring 2024 census, over 500 schools have changed their MIS provider, with the biggest winners once again being Arbor, who gained 477 schools, bringing their total school numbers up to 5,233.

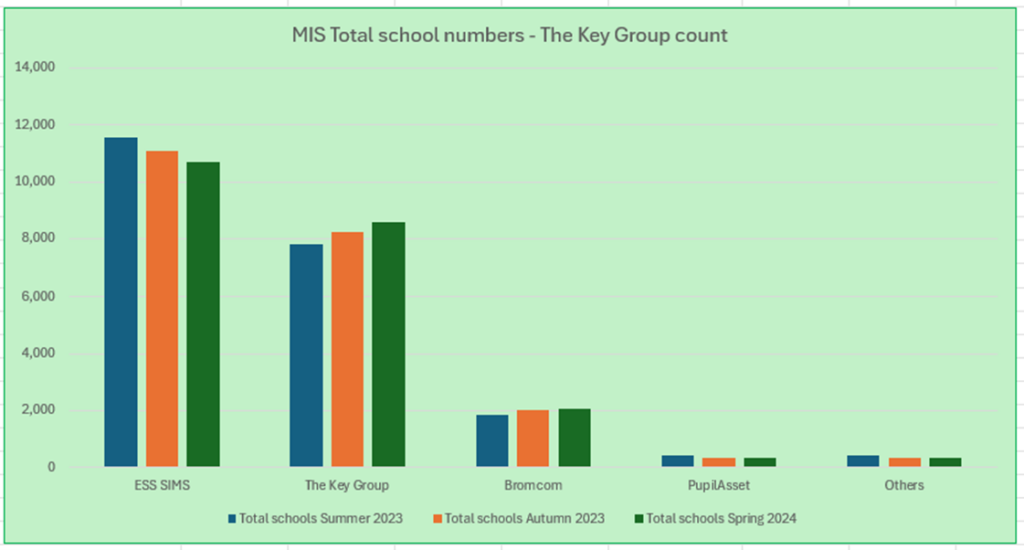

As previously, we see the majority of the switches being away from ESS SIMS, who lost a further 360 schools in this period. If we look back a little further, we see that their total school numbers have fallen from 11,545 in the summer 2023 census to 10,702 in this latest round – a drop of over 800 schools. In that same period, both Arbor (+993) and Bromcom (+206) have gained further market share.

A point well worth making here though, is that Bromcom have recently been announced as the selected MIS provider for all 1,100 schools in Northern Ireland. This is not reflected in the figures here, since these relate only to the English schools’ market, but this is the biggest win possible in the UK market, as there are currently no other single procurement opportunities anywhere near this size. Before winning the Northern Ireland contract, Bromcom had a little over 2,000 schools, so this single contract adds over 50% to their customer base in one go! A fantastic win for Bromcom which shows their ability to bid for, and win, major opportunities in this market.

Having said that, and returning to the English schools’ market, we can see that, with the exception of Arbor and Bromcom, pretty much all the other providers seem to be losing market share. The only outlier here is IRIS Ed:gen who have picked up 29 new schools across this period, bringing them up to 109 schools, although this still isn’t enough to earn an individual spot on our chart.

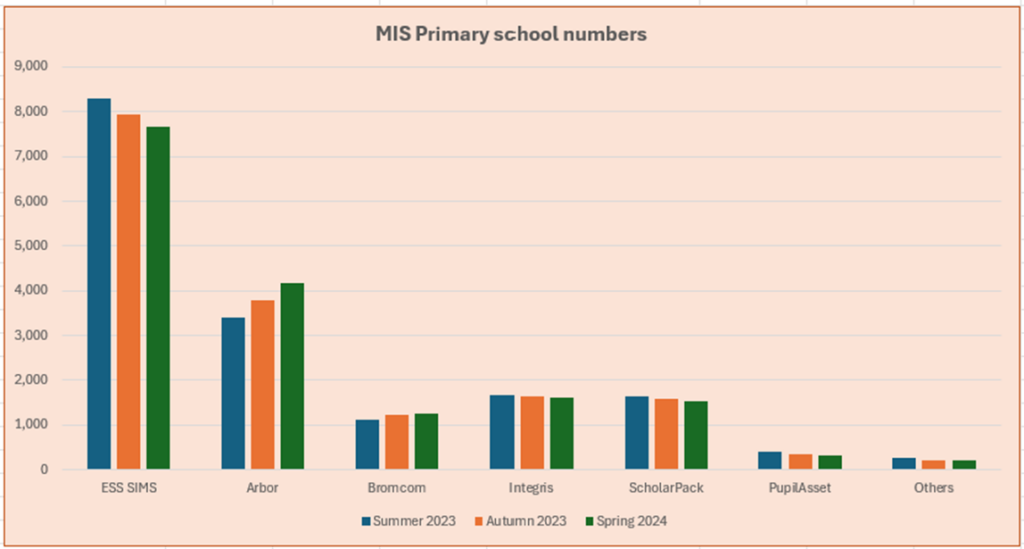

If we look at the picture with primary schools, we see ESS SIMS dropping in numbers, from 8,286 in summer 2023 down to 7,655 in the latest return. Three other MIS providers also lost significant numbers of primary schools across this period – ScholarPack (-106), PupilAsset (-76) and Horizons (-49). Both Arbor and Bromcom picked up more primary schools, with the big winner again being Arbor who have gained almost 800 new primaries since the summer 2023 census.

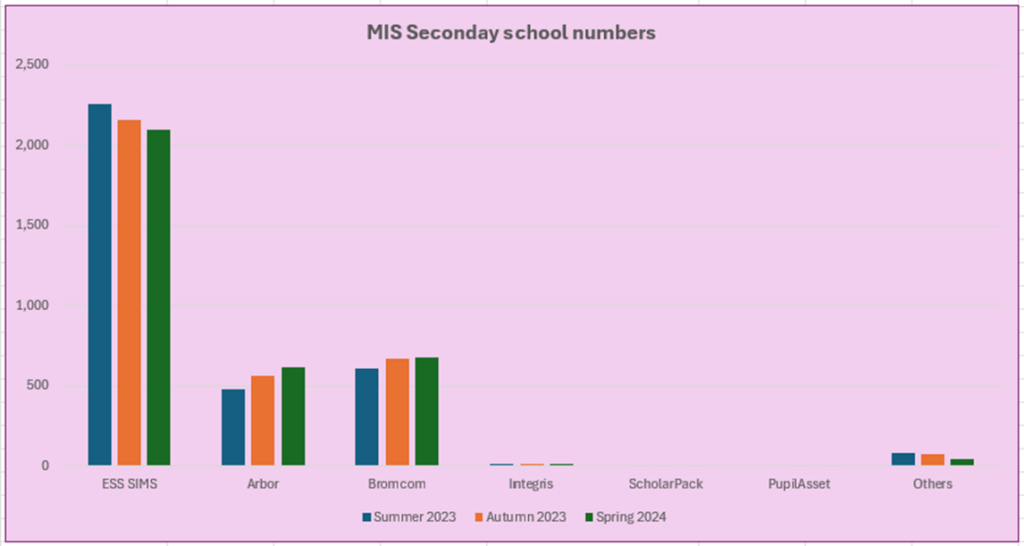

If we then turn our attention to the situation with secondary schools, we see that a similar picture emerges.

The total number of secondary schools is, of course, far less than primaries, however the pattern remains the same. ESS SIMS have lost 61 secondary schools since the autumn 2023 census and a total of 165 since the summer 2023 figures. Once again, it is Arbor (+139) and Bromcom (+72) who are winning these schools.

Whilst we can see that Arbor and Bromcom are gaining market share, this is not the complete picture. Arbor are part of The Key Group, which also owns Integris and ScholarPack. If we look at that group in total, we see that this group now has some 8,588 schools using its MIS solutions, making the group by far the second biggest provider in the English school market.

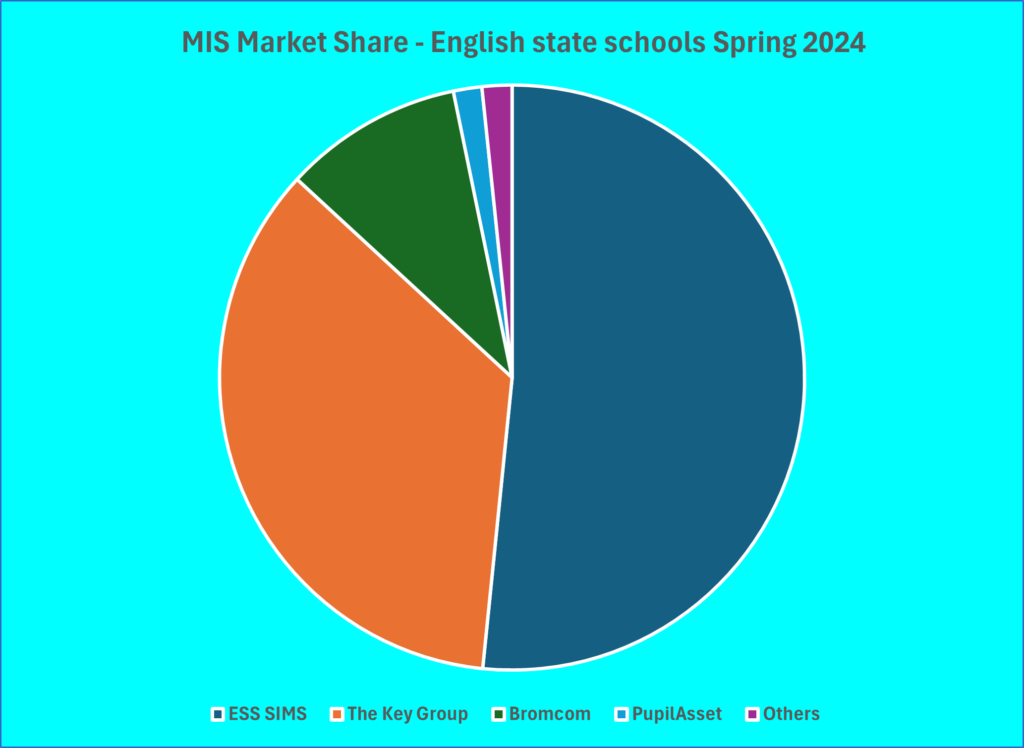

The Key Group now have 39% of the English school market for MIS solutions, having grown from 35% market share since the summer 2023 figures. With ESS SIMS, for many years the majority provider , now down from a high of 83% market share in 2015 to just 48.6% market share now, it looks as if their position as market leader is coming under continued threat.

The view of the English state school MIS market sees a serious contender to become the new market leader:

So, the overall picture after the latest census figures remains that ESS SIMS are losing market share whilst Arbor and Bromcom are continuing to grow.

The vast majority of the controversial three-year deals put in place by ESS are due to end in March 2025 and this makes the next few months very interesting indeed. Since schools need to give 3-months’ notice if they do not intend to renew, this means that any schools who might be thinking of looking around need to do so as soon as possible, or by the end of this term at the latest.

MIS procurement takes time – you don’t just pop down the shops and buy a new MIS! Schools need to consider exactly what they want from any MIS, draw up a detailed specification, decide on their procurement process and then go to market, receive bids/quotes, score these and determine the one that best meets their requirements. All of this takes a great deal of time and effort so any schools or MATs thinking about a change need to start the process soon.

On top of this, if a large number of schools DO decide to move away from ESS SIMS, there is a danger that this wave of new customers could swamp any MIS provider, meaning delays to installations and roll out etc. – another good reason for schools to consider their options now rather than later. For those schools who want to remain with their current provider, this is not a concern, but for those considering a change, that process needs to start now.