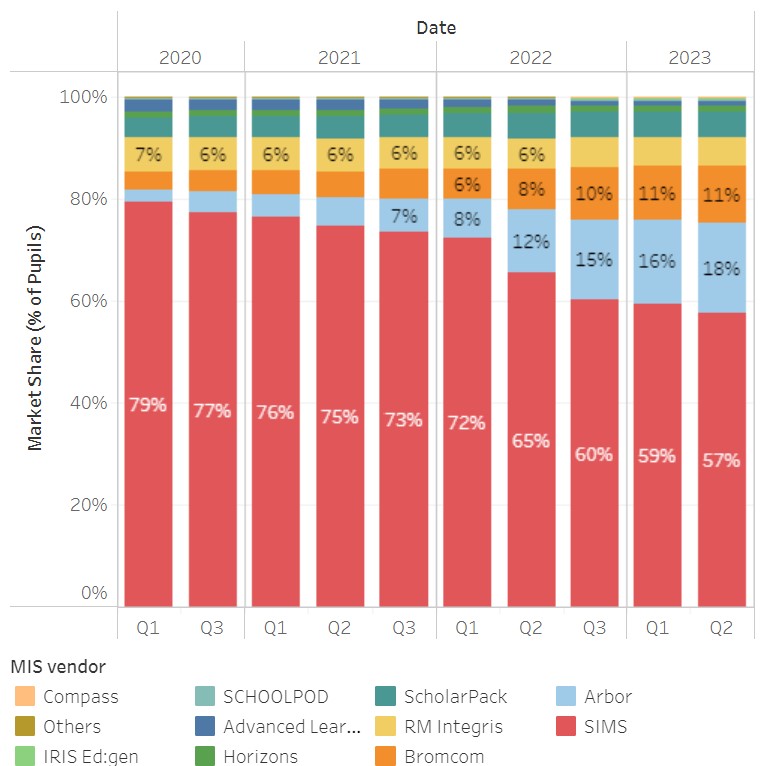

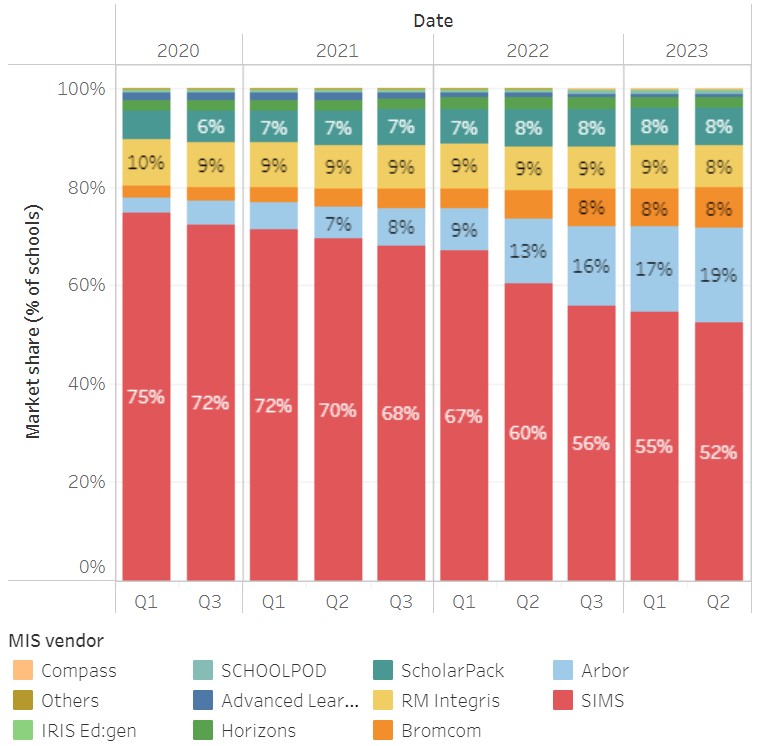

SIMS continues to lose market share; Arbor and Bromcom continue to gain; The Key, with 3 MIS brands in their portfolio, look set to become the biggest MIS provider in England within the next year, although Bromcom have now captured 14% of the academies.

Our thanks, once again, go out to our good friend Joshua Perry who analyses each set of census data and provides insights into the MIS market players, how many schools they have, the ‘winners and losers’ etc. in his blog and allows us to use this data here.

The summer 2023 data is now in and shows that SIMS market share continues to drop – now down to just 52% of schools. This is a staggering drop from their 78% market share only 5 years ago! The last term saw SIMS lose a further 474 schools, on top of the 240 in the previous term and a huge 2,672 lost in 2022.

The Key now have 3 MIS brands – Arbor, ScholarPack and RM Integris – giving them a combined market share of 35% and rising rapidly.

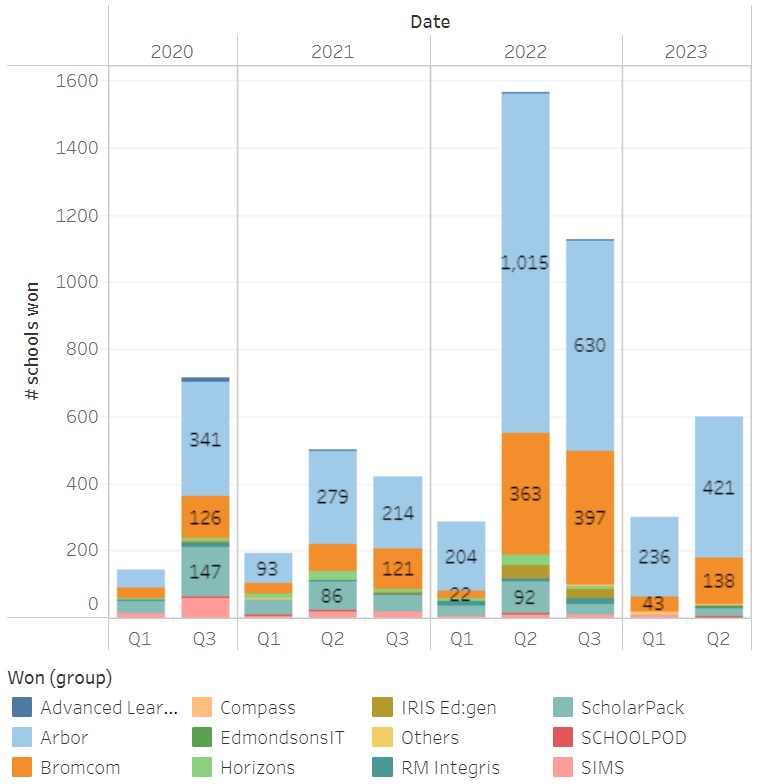

We see that the vast majority of losses have been sustained by SIMS, but who are these schools turning to?

Arbor continues to dominate the wins, in terms of school numbers, with another 421 schools choosing them in the last term. Bromcom, however, are also picking up large numbers of schools, gaining another 138 schools this term. In addition, Bromcom’s share by pupil numbers continues to increase, now up to 11% of the market. This increased share of pupil numbers may well be due to the fact that Bromcom have now captured 14% of the academy market!

How many more schools are considering switching their MIS? It is difficult to know for sure, but it certainly seems to be something that large numbers of schools are actively considering and we expect to see further churn in the market over the coming months.