The census data is in, and the new MIS market share stats are here!

Our thanks, once again, go to our good friend Joshua Perry who analyses each set of census data and provides insights into the MIS market players, how many schools they have, the ‘winners and losers’ etc. in his blog which we urge you to read.

So, what are the headlines?

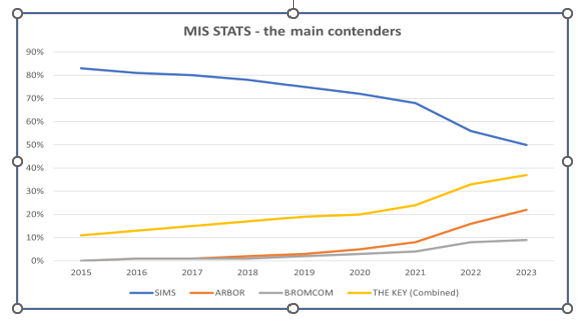

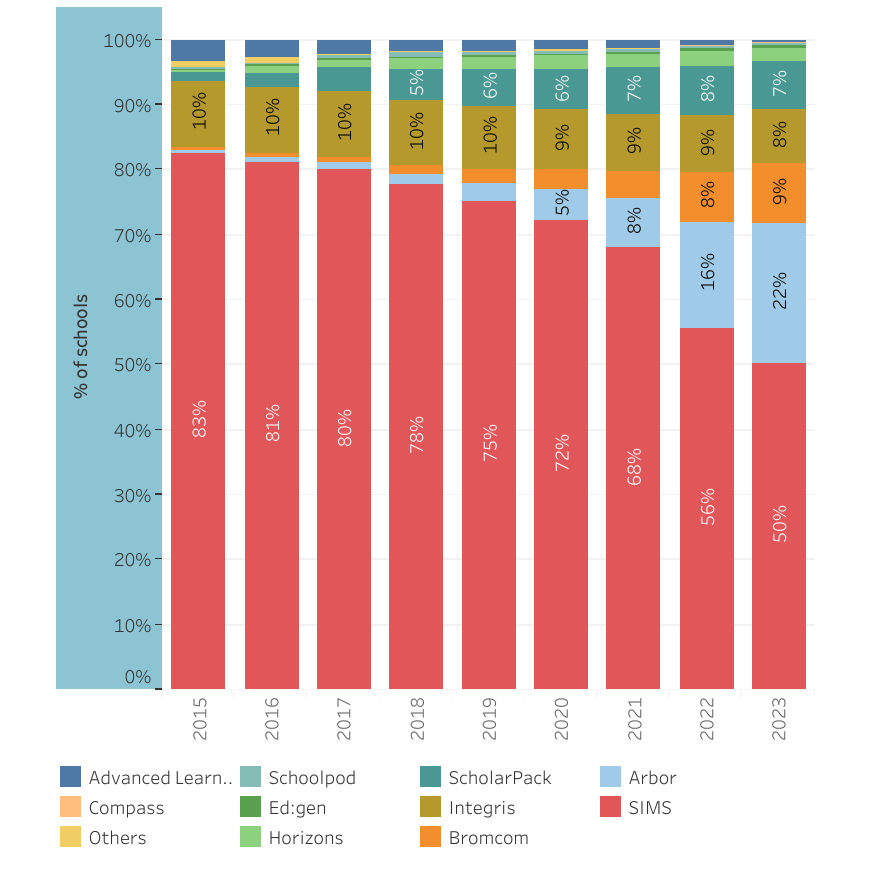

- SIMS continues to lose schools to other providers.

In the past 12 months, they have lost 1,216 schools – almost 10% of their market. This is in addition to the almost 20% that left them in the previous 12 months (another 2,738 schools lost). That makes almost 4,000 schools that have ditched SIMS over the past 2 years…

- SIMS are now down to just 50% market share of English state schools.

To put that figure into context, the SIMS market share just 5 years ago was 78% and as recently as 2017 they held over 80% of the market. Obviously, there have been a number of factors causing this rapid drop – not least the wait for a truly cloud-based version of their product (not likely to be ‘fully complete’ until 2026…) alongside some interesting business tactics such as enforcing 3-year contracts etc.

- Free to use MIS offers.

Many of the major MIS providers now offer free of charge periods where they allow schools to move to their offering without having to pay until their current MIS contract ends, making it far easier for schools to move MIS than ever before.

- Arbor had its best share of wins ever.

Arbor won over 1,200 schools in the past year, some 71% of all schools that switched MIS. Granted, some 150 of these were switched from other Key Group offerings, but it is still an incredibly impressive win rate.

- The Key now have some 37% of all English state schools.

If you combine their three MIS offerings together (Arbor, Integris and ScholarPack), they now have a very credible ‘second place’ and, if the churn rates continue in the same vein over the next couple of years we could easily see them overtake SIMS and become the market leaders.

- Bromcom have also experienced notable growth this year.

They have added almost 400 schools to their estate and have moved up to 12.5% market share overall, and 20% market share in secondary schools. Their share of the secondary schools’ market puts them in second place behind SIMS and ahead of their nearest rivals Arbor.

- IRIS Ed:gen is now over the 100 school mark.

With a total of 115 schools now using their product, IRIS Ed;gen is definitely making headway with a sizeable number of schools now happy using them.