The education technology sector has seen significant consolidation over the past few years. One only needs to think of the likes of Iris, Community Brands, The Key or Juniper coming into the market like magpies, collecting a number of shiny EdTech businesses in a relatively short period of time.

The past 5 years has also seen significant flux in the UK’s management information system market – and not just because the four groups mentioned above each acquired one or more MIS’s.

Let’s just take a look at some of the purchases made in that period:

- June 2018 – The Key acquires ScholarPack

- April 2020 – Engage is acquired by Education Horizons Group

- October 2020 – Iris acquires iSAMS

- December 2020 – The Key acquires Arbor

- December 2020 – Montagu announces it will ‘take on’ SIMS (with ParentPay in the mix)

- February 2021 – Iris launches ed:gen (the first new MIS in a generation)

- June 2021 – Juniper Education acquires Pupil Asset (and renames it Horizons)

- December 2022 – The Key announces intention to acquire RM Integris and RM Finance

We’ve seen MIS’s be acquired where nothing much changes – the acquisition of SchoolPod by Community Brands in 2017 was uneventful. Similarly nothing much changed, at least on the surface, when Furlong was acquired by Volaris a month later.

More recent acquisitions seem much more significant, they are acquisitions with apparent intent to make a change, to readdress the balance that has been lacking in a market led by a company with such a huge share of the available pie.

It was clear to many of us, even before they were acquired by The Key, just how disruptive Arbor were starting to become as a market challenger. They gained confidence, they had a plan and they were executing it very well. And this happened to coincide with the apparent capitulation of the then Capita SIMS.

In his insightful blog, MIS Market Moves – Winter 2022, Joshua Perry summarises his market analysis:

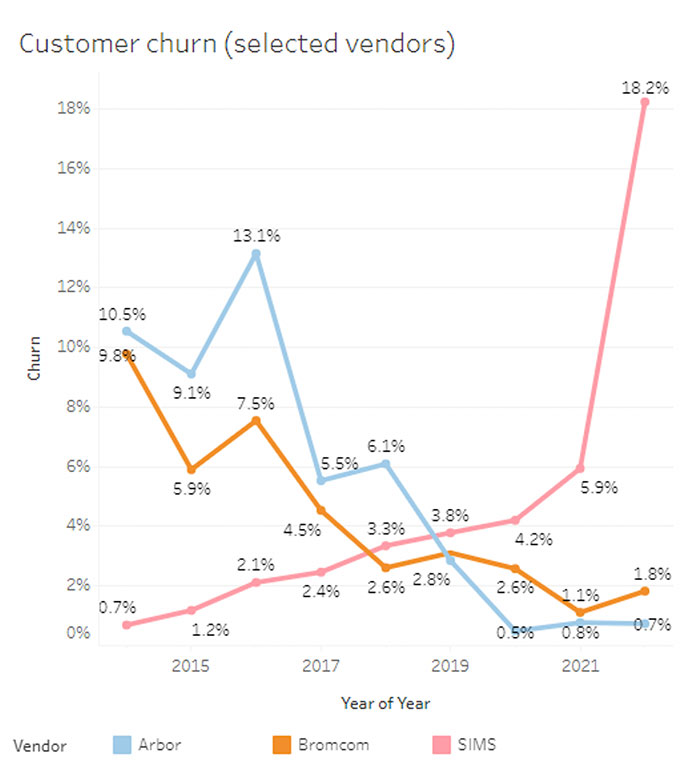

“Over the past year SIMS lost 18% of their market share. 2,734 English state schools took a look at what SIMS was offering and decided to move elsewhere. To put that in context, almost 3 times as many schools left SIMS over the past year compared to the previous 12 months (2022: 2,734; 2021: 942).

The above chart also shows the churn rates for the leading challengers. Both Arbor and Bromcom have churned at under 3% for the past 4 years now, and Arbor has been at under 1% for the past 3 years.”

Not only do both Arbor and Bromcom have a significantly better customer retention rate, they are winning more new schools than anyone else. Joshua points out that Arbor gained 1,887 schools in the previous year, while Bromcom almost doubled their school customers (to 1,688 in 2022 from 885 in 2021).

However on-boarding new schools at scale is a challenge in itself. When that’s taken in the context of organisational change it can be even more difficult. This might involve restructuring and cultural integration not to mention competing strategies, technologies and roadmaps, just to name a few potential ‘distractions’.

Might it be that the goings on at The Key (now with three, previously competing, MIS’s) and ESS SIMS might actually represent an opportunity for some of the other players? Bromcom don’t have the distraction of acquisition or the corporate pressure from rapidly dwindling customer numbers. Other players, such as AIMS, Compass, Ed:gen or the forthcoming Satchel:One are developing from the ground up, not retro-fitting existing platforms on potentially divergent technology stacks.

Innovation can also be more problematic when you’re focused on integrating existing product sets. This might give new market entrants or existing players that don’t have to contend with deeper organisational challenges the advantage.

This is largely speculation – as external observers who’ve been involved in the market for decades.

We’ve set up WhichMIS? because it’s an incredibly exciting time for education technology as a whole – and for the MIS market in particular.

What’s certainly true is that we’ve seen lots of change, and a market that is more balanced, and with more opportunity to develop, than it has been in a significant period of time.

Thanks to Joshua Perry (and his blog, Bring More Data) for his permission to quote him directly.